Topping is a process and no matter how strong the intellectual bearish case may be, it is hard to stop a monetary based bullish mob psychology phenomenon. When I am not in my trading groove, my approach is to play smaller and faster the more I get confused about the state of the market. I look at the charts of the averages and of individual stocks to guide my decision making. That is my final arbiter. At this specific moment, I see some groups like solar, 3D Printing, biotechs, former leaders like SBUX down, but other stocks and groups up.

At this moment in time, the charts are telling me to play the game, but be extremely cautious. I don't think that I have been more than 25% long since 2014 began. Right now I am less than 10% long and sitting mostly in cash. But that does not matter to much because I trade fast and can turn on a dime in this type of market.

Here are some interesting statistics that I have gleaned from various commentators. From Goldman Sachs: "When Will The Party End?"

http://www.zerohedge.com/news/2014-03-08/when-does-party-end%E2%80%9D-goldman-finds-revenue-multiples-have-never-been-higher

Percent of M&A Deals Paid By Stock is at record highs

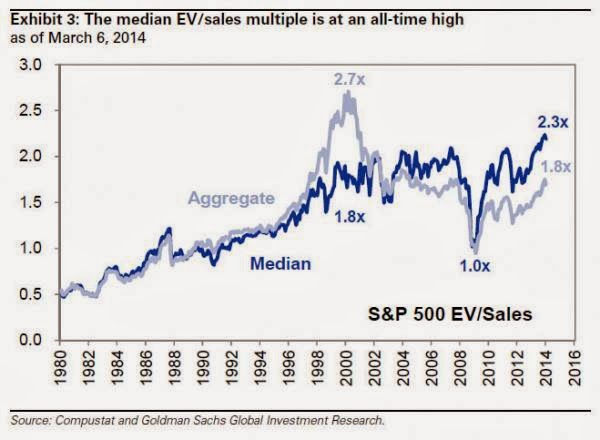

Median EV Multiples are at record highs:

The Length of The Bull Market is Getting Into End Game Territory.* Sure Bull markets have gone on longer and we are not at extremes yet - But we are in the 5 pus year end game zone. ZeroHedge* And this is the slowest economic growth in US history:

Global Debt Crosses $100 Trillion, Rises By $30 Trillion Since 2007; $27 Trillion Is "Foreign-Held"* ZeroHedge*

China's First Bond Default has occurred and Copper Prices - a coincident indicator - are falling rapidly. We can't have it both ways. If China's economy is a market driver up. it works both ways. China's exports are collapsing.

Obama's Foreign Policy gets Even Worse. Last week on Charlie Rose Henry Kissinger said flat out the rule number 1 in diplomacy 101 is to keep the leaders out of the discussions during times of crises. That is because two hot heads tend to get angry and dig in their heals when they speak to each other. It is better for cooler well trusted foreign affairs experts and negotiators to do the talking. So instead of Obama doing the smart things and giving Russia a way out, he is conducting a public pissing contest with Putin. Message to Obama - you lost the Crimea and maybe the Ukraine, shore up the rest of the old Soviet satellites but don't push Putin too hard on the Crimea because you messed up and have to save face. You may be escalating a situation that you put us in with too little, too late, with the end result being much worse for the international economy than you hastily thought. Had you had your ducks in a row in the first place, the situation may have been different. Maybe you would still have lost Ukraine, but the overall fall out would be different.

In sum, the employment numbers are atrocious despite what the TV talking heads are saying. Yellin is boxed into a tapering corner that is playing out over a long time. The world's economies are getting worse. Word tensions are getting higher. The amount of money out there is humongous and may still be enough hold up the market, but the case for a US economic recovery is no way convincing and stocks are extended. Market's do not usually turn on a dime unless a real Black Swan event occurs, but the game of attrition is not good.

BIG Capital Advisors and Seaview Partners are not responsible for your investment decisions. We believe very strongly in our opinions, but you must perform your own due diligence in making your investment decisions.

No comments:

Post a Comment